[ad_1]

Wall Avenue merchants despatched shares and bonds sliding after one other sizzling inflation report signaled the Federal Reserve might be in no rush to chop charges this yr. Oil climbed as geopolitical jitters resurfaced.

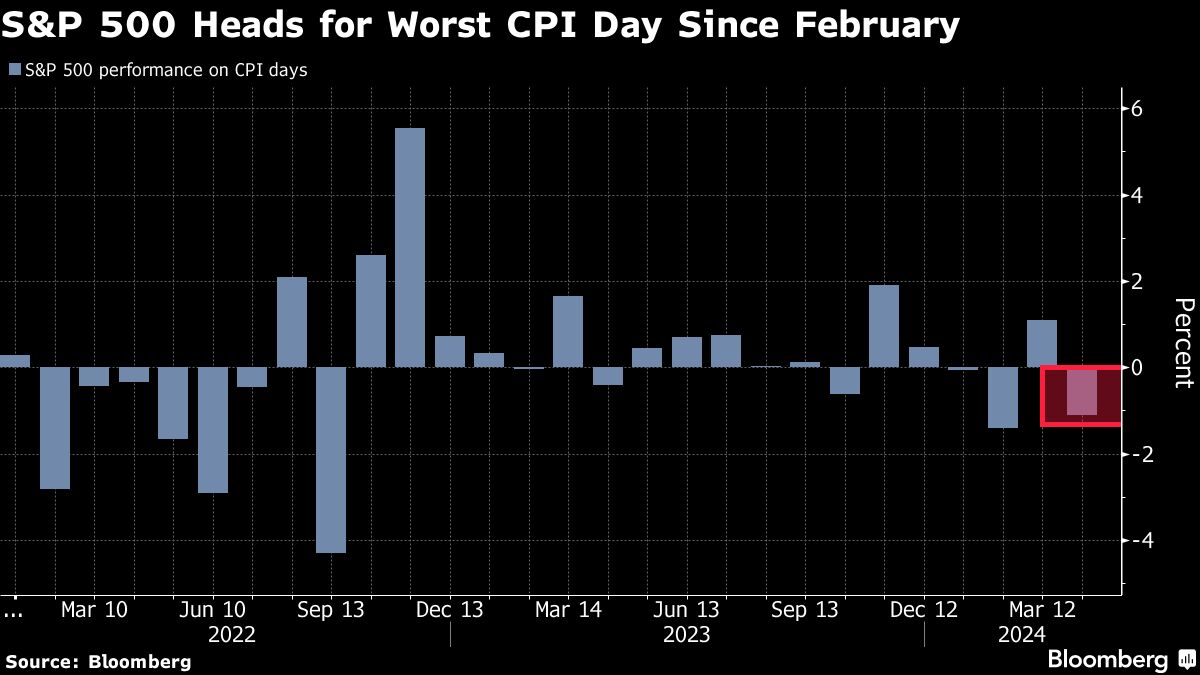

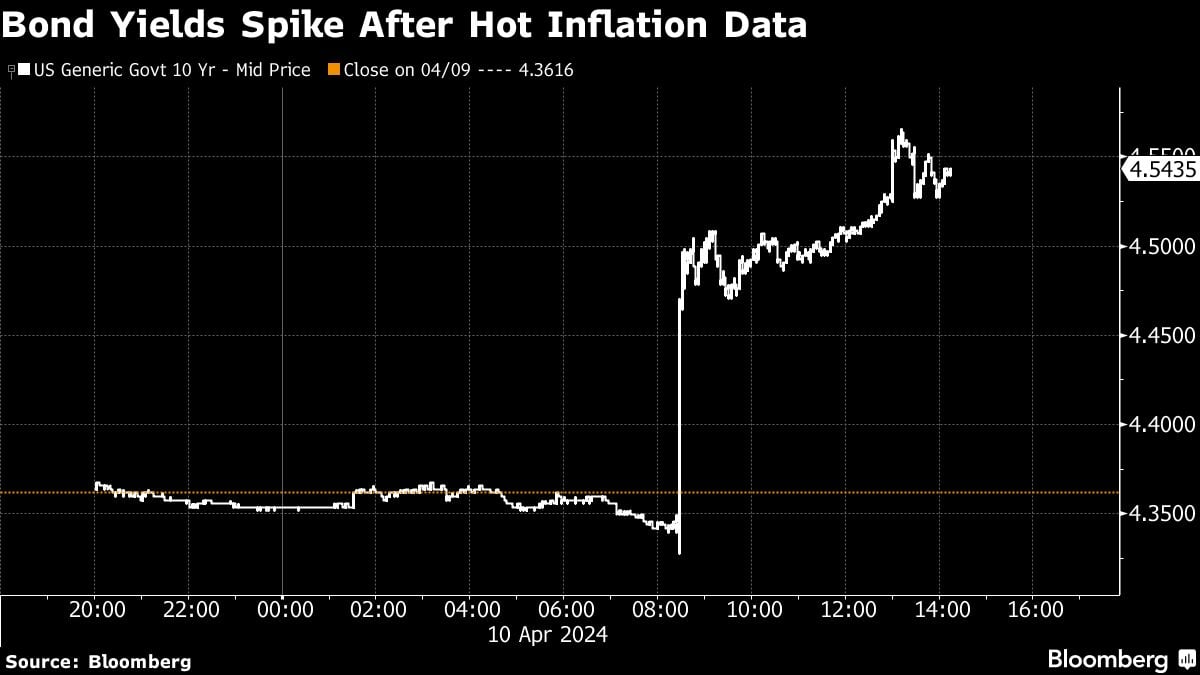

Equities prolonged their April losses, with the S&P 500 down about 1% as the patron value index topped economists’ forecasts for a 3rd month. Treasury 10-year yields topped 4.5%. Fed swaps at the moment are displaying bets on solely two fee cuts for the entire yr.

A pointy reversal in oil additionally weighed on sentiment, with Bloomberg Information reporting the U.S. and its allies consider main missile or drone strikes by Iran or its proxies on Israel are imminent.

Because the Fed rides the so-called final mile towards its 2% inflation purpose, buyers’ concern is that the current value pressures will not be only a “blip” — with the higher-for-longer fee narrative taking maintain.

Minutes of the most recent Fed assembly confirmed “virtually all” officers judged it might be applicable to pivot “sooner or later” this yr. However inflation since then has upended market bets.

“It’s usually mentioned that the Fed takes the escalator up and the elevator down when setting charges,” mentioned Richard Flynn at Charles Schwab. “However for the trail downwards on this cycle, it seems to be like they are going to go for the steps.”

The Fed minutes additionally confirmed policymakers “usually favored” slowing the tempo at which they’re shrinking the central financial institution’s asset portfolio by roughly half.

The S&P 500 dropped to round 5,150. Treasury two-year yields, that are extra delicate to imminent Fed strikes, surged 22 foundation factors to 4.96%. The greenback headed towards its greatest advance since January. Brent crude topped $90 a barrel once more.

The March core shopper value index, which excludes meals and power prices, elevated 0.4% from February, in line with authorities information out Wednesday. From a yr in the past, it superior 3.8%, holding regular from the prior month.

The March core shopper value index, which excludes meals and power prices, elevated 0.4% from February, in line with authorities information out Wednesday. From a yr in the past, it superior 3.8%, holding regular from the prior month.

These figures — alongside the roles report launched final week — complicate the timing of the Fed’s fee cuts, in line with Tiffany Wilding at Pacific Funding Administration Co.

Not solely there’s now a powerful case to push out the timing of the primary minimize previous mid-year, it additionally strengthens the percentages that the U.S. will ease coverage at a extra gradual fee than its developed-market counterparts, she famous.

“Inflation proper now’s just like the ‘cussed youngster’ that refuses to heed the father or mother’s name to depart the playground,” mentioned Jason Satisfaction at Glenmede. “Two cuts is now seemingly the bottom case for 2024. Because of this, buyers must be ready for a higher-for-longer financial regime.”

That doesn’t imply charges are going larger — however the distance to a fee minimize is one other quarter, in line with Jamie Cox at Harris Monetary Group.

“You’ll be able to kiss a June interest-rate minimize goodbye,” mentioned Greg McBride at Bankrate. “There isn’t a enchancment right here, we’re transferring within the flawed course.”

To Neil Dutta at Renaissance Macro Analysis, Fed officers are nonetheless reducing this yr, however they received’t be beginning in June.

“I feel July is possible, which implies two cuts stay an inexpensive baseline,” Dutta mentioned. “If the Fed doesn’t get a minimize off in July, nevertheless, buyers might want to fear about path dependency. For instance, would September be too near the election? If not June, then July. If not July, then December.”

Development vs. Inflation

At first of the yr, the quantity of easing priced in for 2024 exceeded 150 foundation factors. That expectation was based mostly on the view that the US financial system would sluggish in response to the Fed’s 11 fee hikes over the previous two years. Moderately, progress information has broadly exceeded expectations.

“Simple monetary circumstances proceed to supply a big tailwind to progress and inflation. Because of this, the Fed just isn’t carried out combating inflation and charges will keep larger for longer,” mentioned Torsten Slok at Apollo World Administration. “We’re sticking to our view that the Fed is not going to minimize charges in 2024.”

[ad_2]