[ad_1]

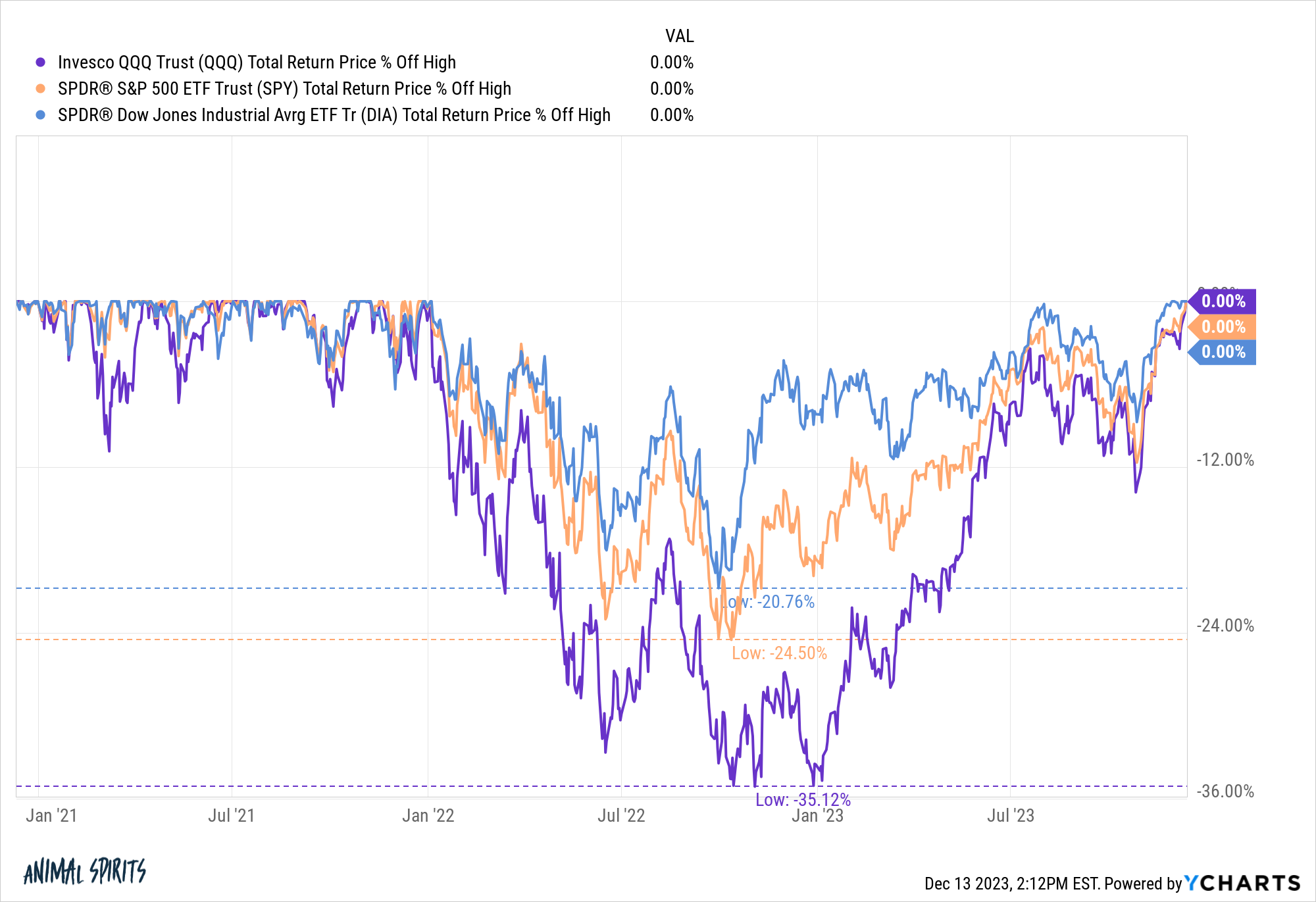

After struggling drawdowns of 21%, 25% and 35% within the bear market of 2022, the Dow, S&P 500 and Nasdaq 100 all broke even on a complete return foundation this week:

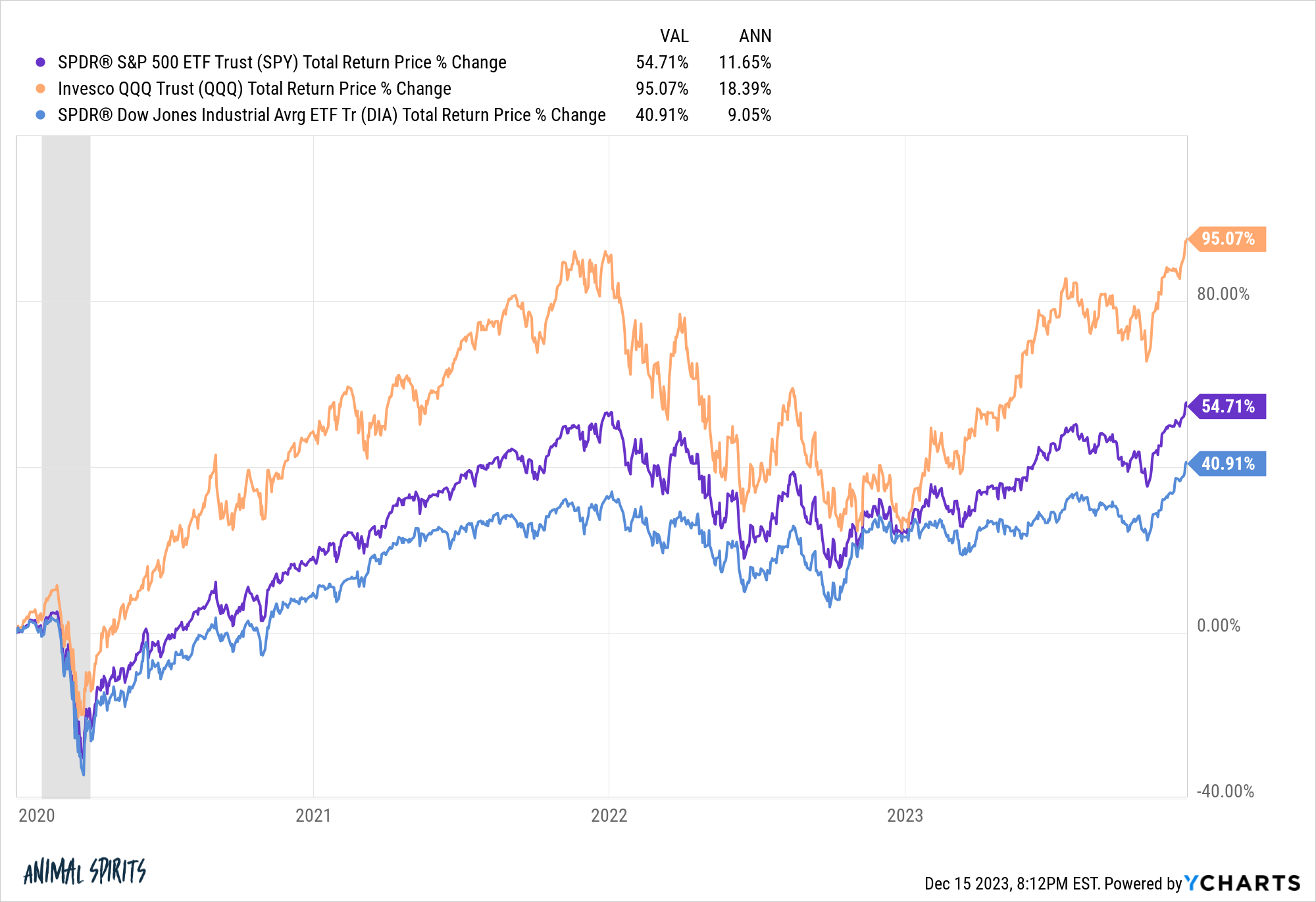

Positive meaning these markets went nowhere for practically two years however simply have a look at the returns because the begin of 2020:

Contemplating all the pieces we’ve lived via these returns will not be dangerous in any respect.

One among my least favourite phrases in all of investing is the straightforward cash has been made.

Earning profits within the monetary markets is by no means simple.

You’re compelled to cope with fixed uncertainty, volatility, concern, greed, and an countless stream of noise.

It solely ever feels simple within the rearview mirror.

Simply take into consideration all the pieces buyers have needed to cope with these previous few years:

- The pandemic precipitated us to show off the financial system for 1-2 months within the spring of 2020.

- The unemployment fee shot as much as 14%.

- We had no thought how lengthy the pandemic would final or once we would discover a vaccine.

- March 2020 was one of many worst months in inventory market historical past.

- Rates of interest fell to historic lows.

- Oil costs went damaging.

- We skilled the quickest bear market from all-time highs to down 30% ever.

- Then shares got here roaring again.

- There was a meme inventory/crypto bubble.

- Inflation got here again from the useless to succeed in its highest stage in 40 years.

- We had a nasty bear market in 2022.

- The Fed took short-term charges from 0% to five% in a rush.

- The bond market noticed its worst crash in historical past.

- The 60/40 portfolio had one in every of its worst years ever.

For the previous two years buyers have been inundated with predictions of a recession, a repeat of the Seventies, stagflation, a housing market crash and worse.

None of this stuff occurred.

It’s unbelievable how nicely issues have labored out these previous few years all issues thought of. There aren’t any counterfactuals however issues have turned out a lot worse.

Sure, the fiscal response from the federal government was immense however it wasn’t a foregone conclusion it could work. Definitely nobody predicted this financial end result forward of time.

This was an financial experiment in contrast to something we’ve ever tried earlier than.

Inflation has not been enjoyable to cope with however issues may have been far worse contemplating Russia invaded Ukraine when costs had been already spiraling uncontrolled. Inflation may have been much more disagreeable than it has been if the worldwide provide chain hadn’t healed in a comparatively quick time period.

The Fed may have damaged issues once they raised charges from 0% to five% so quick. The explanation so many economists and pundits had been predicting a recession in 2022 and 2023 is as a result of we’ve by no means introduced inflation down from such lofty heights with out an financial contraction.

For those who injected Jerome Powell with fact serum I’m guessing he would let you know there was no approach a gentle touchdown was attainable 15-18 months in the past.

The truth that we’ve finished so so far is an financial miracle.

Perhaps we go right into a recession or one other bear market in 2024 or 2025 or at any time when. It’s certain to occur in some unspecified time in the future.

No matter how issues turned out, I want to give kudos to those that caught with their funding plan all through this ordeal.

For those who dutifully greenback value averaged in when shares had been falling give your self a pat on the again. You probably did the correct factor.

For those who rebalanced your portfolio when shares fell, nice job.

For those who rode out the losses with out panic-selling on the backside, good work.

For those who ignored the individuals who had been screaming at you each day about how a lot worse issues had been going to get, excellent efficiency.

For those who stored your asset allocation in place when individuals on the Web had been making an attempt to pitch you ridiculous funding choices, good on you.

For those who didn’t have a look at your 401k stability for the previous couple of years, you’re higher off for it ultimately.

For those who did nothing to your portfolio as a result of that’s what your plan referred to as for, I applaud you.

Look, the clock by no means runs out on the markets. The sport by no means ends. Bull markets flip into bear markets which flip into bull markets and spherical and spherical it goes.

The whole lot is cyclical.

There will likely be tougher instances forward in some unspecified time in the future. There will likely be crashes that make the 2020 and 2022 bear markets look quaint by comparability.

However typically it’s good to take a seat again and recognize the way you dealt with sure components of the cycle.

Staying the course is tougher than it sounds.

Additional Studying:

Everyone seems to be Irrational

[ad_2]