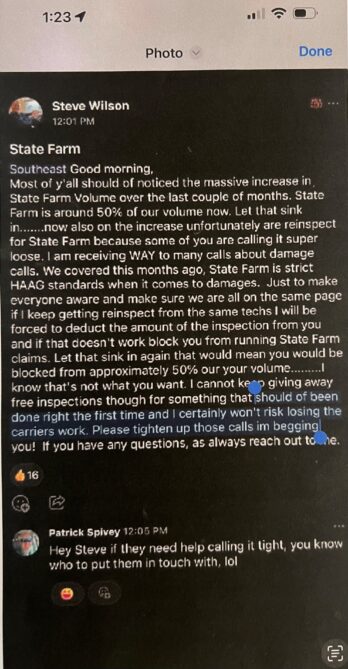

Search Now (fka Ladder Now) is a third-party vendor to insurance coverage firms. It has non-licensed inspectors do work that traditionally was completed by firm or unbiased adjusters. Here’s a memo from a Search Now supervisor to his discipline inspection group:

I used to be displaying this message to numerous adjusters on the First Get together Claims Convention. This convention has an emphasis on Synthetic Intelligence. So, I put the message into ChatGPT for evaluation, and listed here are the outcomes:

I used to be displaying this message to numerous adjusters on the First Get together Claims Convention. This convention has an emphasis on Synthetic Intelligence. So, I put the message into ChatGPT for evaluation, and listed here are the outcomes:

“The textual content you’ve offered seems to be a communication from a supervisor or supervisor named Steve Wilson to a group, seemingly concerned in insurance coverage claims inspections, particularly concerning State Farm claims. Right here’s an evaluation of the important thing factors:

- Improve in State Farm Quantity: The message begins by acknowledging a big improve within the quantity of State Farm claims, which now includes about 50% of the group’s complete workload. This is a crucial context, because it signifies a heavy reliance on State Farm for enterprise.

- Subject with Reinspections: The message highlights an issue with reinspections because of some group members conducting assessments loosely. Reinspections normally happen if an preliminary inspection is deemed insufficient or inaccurate, indicating a possible problem with the standard of labor.

- Strict Requirements and Penalties: Steve emphasizes that State Farm adheres to strict HAAG requirements for injury assessments. He warns that continued reinspections, significantly from the identical technicians, might result in monetary penalties (deducting the inspection price from the technician) and even barring them from dealing with State Farm claims. That is vital because it may influence their workload by roughly 50%.

- Urgency and Threat of Dropping Enterprise: There’s a way of urgency within the message. Steve is worried in regards to the threat of shedding State Farm as a shopper because of substandard inspections. He urges the group to enhance their evaluation high quality and align with the required requirements.

- Open Communication: The message concludes with an invite for group members to succeed in out if they’ve questions, indicating a willingness to help and supply steering.

- Response from Patrick Spivey: Patrick’s response, although temporary and considerably humorous (‘lol’), suggests a readiness to help or present experience in ‘calling it tight’, i.e., making correct and strict injury assessments.

General, the message conveys a critical concern in regards to the high quality of labor and its implications on enterprise relationships and income. It stresses the necessity for adherence to requirements and high quality management to keep up an important enterprise relationship with State Farm.” To me, the message was clear. Make your opinions about injury decrease or face getting decreased wages. How do you assume State Farm policyholders would really feel if that they had an inspector from Search Now making determinations on their declare? How would you are feeling if it have been your declare?

Policyholders, insurance coverage regulators, and the general public want to know that many within the insurance coverage claims trade are pushed to cut back the quantity paid on claims. Whereas all people acknowledges that good religion with full and immediate fee is the usual, the present claims tradition is to pay as little as doable. Many third-party distributors will promote out to assist insurance coverage firms do that.

This is the reason so {many professional} and moral claims adjusters are leaving the insurance coverage claims trade. They can’t legitimately reply “why” they’re collaborating in a enterprise that isn’t enjoying by the foundations and requirements of conduct, which give method to the tradition demonstrated on this memo. What occurred to the trade that promised the best of integrity, ethics, and enterprise dealings with policyholders at their best time of want?

I do know many residential property insurance coverage adjusters at Chubb and AMICA could be embarrassed by this memo. Nonetheless, the claims tradition at these two insurance coverage firms could be very totally different than the remainder of the claims trade. For a lot of the remainder of the property insurance coverage claims trade, these kinds of memos and cultural attitudes are why our regulation agency attorneys are fairly busy.

Thought For The Day

At all times do proper. This can gratify some folks and astonish the remainder. Mark Twain

[ad_2]