[ad_1]

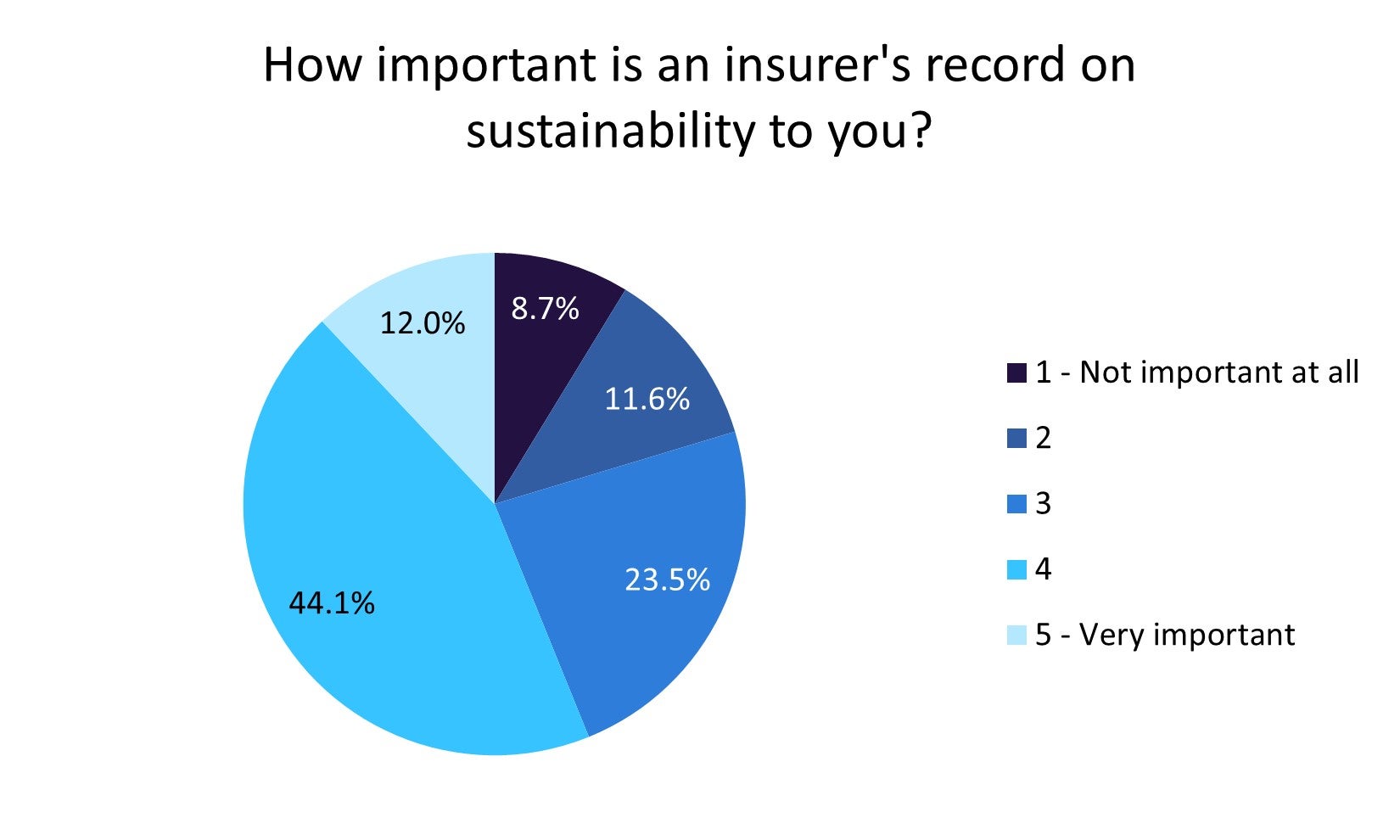

Sustainability is more and more talked about within the client panorama, with 56.1% of respondents to GlobalData’s 2023 UK Insurance coverage Client Survey pondering that an insurer’s file on sustainability is vital or crucial. In line with this, The Inexperienced Insurer, a newly launched, sustainability-focused motor insurance coverage dealer, has launched a proposition that actively lowers its shoppers’ carbon footprint along with providing motor cowl. With using telematics information and a scoring system, the corporate hopes to encourage policyholders to drive extra eco-friendly.

In GlobalData’s 2023 UK Insurance coverage Client Survey (see above), clients had been requested to rank their insurer’s sustainability file on a scale of 1 (not crucial) to five (crucial). In 2023, 56.1% of respondents answered 4 or 5. As well as, 50.8% of shoppers noticed will increase of their 2023 automobile insurance coverage premiums by a spread of 0–20%. Moreover, 19.3% reported hikes within the vary of 21–40%. In gentle of this, The Inexperienced Insurer is combating rising premiums by negotiating agreements with insurers to decrease prices. Moreover, as a part of its Leaves scheme, the corporate gives rewards averaging £20 per 12 months for environmentally aware driving. This helps a bunch effort to minimize environmental impression along with addressing the monetary burden on drivers.

The proposal from The Inexperienced Insurer is an try to assist each the setting and shoppers. The product makes use of a smartphone app to observe driving behaviours and assign Inexperienced Driving Scores, which have a direct impression on renewal premiums and can be utilized to unlock reductions. The Leaves scheme provides incentives to policyholders within the type of annual rewards. The outcomes of its survey present that 53% of drivers are extra environmentally aware than they had been a 12 months in the past and that 28% of them intend to drive fewer miles, highlighting the significance of those choices. The technique utilized by The Inexperienced Insurer meets the wants of each clients who’re involved in regards to the setting and those that are in search of a means out of rising premiums for insurance coverage. The corporate is nicely positioned in an evolving insurance coverage panorama due to its distinctive mixture of monetary advantages and eco-friendly incentives. To remain aggressive and match their merchandise with the shifting priorities and preferences of immediately’s drivers, different insurers may take related measures into consideration as sustainability stays fashionable amongst shoppers. Along with retaining their clientele, insurers can assist create a extra sustainable and accountable future by tackling each cost- and environment-related points.

Entry probably the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nevertheless, we wish you to take advantage of

helpful

choice for your small business, so we provide a free pattern that you may obtain by

submitting the under kind

By GlobalData

[ad_2]