[ad_1]

Canadian rates of interest modifications:

The subject of rates of interest impacts quite a few points of day by day life. Whereas the rates of interest in Canada have been low for over a decade, final yr Canadians noticed unprecedented charge will increase, reaching ranges final seen in 2008.

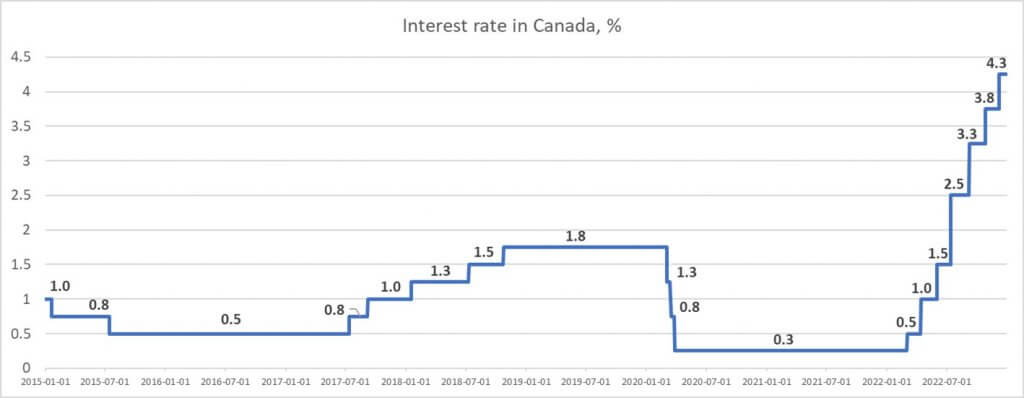

The chart under illustrates the evolution of the rates of interest between January 2015 and January 2023. Whereas curiosity various between 0.5% and 1.8% between January 2015 and July 2022, charges skyrocketed to 4.3% by the top of 2022.

Rates of interest have an effect on actual property affordability and the price of borrowing cash. For instance, over the previous yr each fastened and variable mortgage charges have elevated between 3% and 4% respectively, with probably the most present charges sitting between 4.99% and 5.99%.

How have modifications in rates of interest impacted mortgage qualification standing?

With the Financial institution of Canada growing rates of interest all through 2022, Canadians have seen a large change in each the quantity of mortgage they’ll qualify for in addition to the month-to-month funds related to their mortgage.

The elevated curiosity has brought on the common mortgage cost to develop between 45% and 60%, and the quantity a purchaser can borrow to lower by about 38% yr over yr, which has been one of many essential drivers forcing housing costs decrease.

Listed here are two situations to place these numbers in perspective when evaluating modifications in month-to-month mortgage funds and the quantities a Canadian family can borrow as of the start versus the top of final yr.

| State of affairs | Starting of 2022 | Finish of 2022 | Change |

| State of affairs 1 | Mortgage: $400,00 (25-year amortization)

Month-to-month cost: $1,692 |

Mortgage: $400,00 (25-year amortization)

Month-to-month cost: $2,556 |

Month-to-month cost enhance: +51% |

| State of affairs 2 | Family incomes $100,000 yearly.

May be permitted for $600,000-mortgage. Month-to-month cost: $2,142 |

Family incomes $100,000 yearly.

May be permitted for $500,000-mortgage. Month-to-month cost: $2,745 |

Lower within the quantity of mortgage to qualify for: -20%

Month-to-month cost enhance (normalized for $100K): +54% |

The primary instance above demonstrates that a rise in charges has brought on the common mortgage cost to extend between 45% and 60%. For a mortgage of $400,000 with a 25-year amortization, the cost is as much as $2,556 from $1,692 a yr earlier.

From the second instance above, we see {that a} Canadian family incomes $100,000 yearly (with some assumed residence possession bills) may have been permitted for an approximate $600,000 mortgage with funds of $2142/month-to-month at first of the final yr. This similar family, in December 2022, is taking a look at an approximate $500,000 mortgage approval with funds of $2,745/month-to-month.

This can be a 20% drop within the quantity of mortgage a Canadian can qualify for, which interprets into 20% much less they’ll spend on a house.

Do variable or fastened mortgage charges make sense within the present monetary local weather?

Presently, we’re in very distinctive occasions with short-term bond yields (and mortgage charges) being larger than 5-year phrases. Traditionally, variable charges have supplied higher financial savings in comparison with fastened charges, each in charge and mortgage exit penalties.

Shoppers, nonetheless, ought to all the time choose an rate of interest based mostly on their danger tolerance and objectives, as 2022 has proven us that we aren’t resistant to fast charge will increase. Present market circumstances on the time of acquiring a brand new mortgage or renewing should even be factored into the choice course of. In December 2022, variable charges had been larger than fastened charges, making fastened charges extra enticing.

Some forecasters imagine fastened charges are at their peak, so to lock into in the present day’s charges for five years isn’t enticing to many. Moreover, with talks that the Financial institution of Canada may decrease charges on the finish of 2023, there could also be a superb alternative for decrease charges within the subsequent 12 to 24 months. Shoppers are strongly inspired to contemplate shorter phrases (1- to 3-year fastened charges) to maintain the chance open to acquire a decrease charge when charges come down once more.

Mortgage dealer recommendation: Think about a short-term mortgage (1-, 2- or 3-year fastened charge) as there’s a good likelihood that charges will go down within the subsequent 12-24 months.

Each individual’s state of affairs is exclusive; it’s clever for customers to hunt unbiased recommendation on the very best mortgage product for his or her wants.

About authors:

We thank each Shawn Stillman from Mortgage Outlet Inc. and Armando Cuccione from ApproveU.ca for his or her distinctive insights.

|

|

| Shawn Stillman, CPA, CA Mortgage Dealer/ Co-Founder Mortgage Outlet Inc |

Armando Cuccione Mortgage Marketing consultant Founding father of ApproveU.ca |

[ad_2]