[ad_1]

Two payments proposed in Illinois this 12 months illustrate but once more the necessity for lawmakers to raised perceive how insurance coverage works. Illinois HB 4767 and HB 4611 – like their 2023 predecessor, HB 2203 – would hurt the very policyholders the measures intention to assist by driving up the price for insurers to jot down private auto protection within the state.

“These payments, whereas supposed to handle rising insurance coverage prices, would have the other impression and sure hurt shoppers by decreasing competitors and growing prices for Illinois drivers,” mentioned a press launch issued by the American Property Casualty Insurance coverage Affiliation, the Illinois Insurance coverage Affiliation, and the Nationwide Affiliation of Mutual Insurance coverage Corporations. “Insurance coverage charges are at the start a perform of claims and their prices. Fairly than working to assist make roadways safer and scale back prices, these payments search to alter the state’s insurance coverage score legislation and prohibit the usage of components which might be extremely predictive of the danger of a future loss.”

The proposed legal guidelines would bar insurers from contemplating nondriving components which might be demonstrably predictive of claims when setting premium charges.

“Prohibiting extremely correct score components…disconnects worth from the danger of future loss, which essentially means high-risk drivers can pay much less and lower-risk drivers can pay greater than they in any other case would pay,” the discharge says. “Moreover, altering the score legislation and components used is not going to change the economics or crash statistics which might be the first drivers of the price of insurance coverage within the state.”

Triple-I agrees with the important thing considerations raised by the opposite commerce organizations. As we’ve got written beforehand, such laws suggests a lack of awareness about risk-based pricing that isn’t remoted to Illinois legislators – certainly, related proposals are submitted on occasion at state and federal ranges.

What’s risk-based pricing?

Merely put, risk-based pricing means providing totally different costs for a similar degree of protection, based mostly on threat components particular to the insured particular person or property. If insurance policies weren’t priced this fashion – if insurers needed to give you a one-size-fits-all worth for auto protection that didn’t think about automobile kind and use, the place and the way a lot the automotive shall be pushed, and so forth – lower-risk drivers would subsidize riskier ones. Danger-based pricing permits insurers to supply the bottom attainable premiums to policyholders with probably the most favorable threat components. Charging greater premiums to insure higher-risk policyholders allows insurers to underwrite a wider vary of coverages, thus enhancing each availability and affordability of insurance coverage.

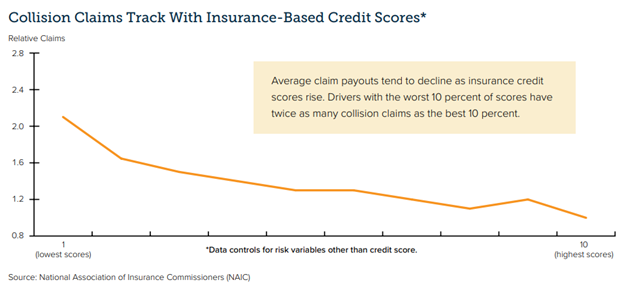

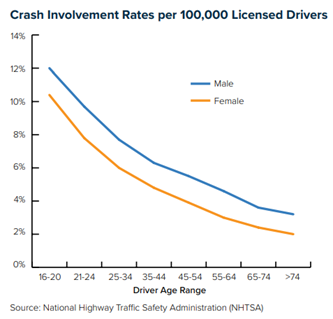

This straightforward idea turns into difficult when actuarially sound score components intersect with different attributes in methods that may be perceived as unfairly discriminatory. For instance, considerations have been raised about the usage of credit-based insurance coverage scores, geography, dwelling possession, and motorcar information in setting dwelling and automotive insurance coverage premium charges. Critics say this may result in “proxy discrimination,” with individuals of coloration in city neighborhoods generally charged greater than their suburban neighbors for a similar protection.

The confusion is comprehensible, given the complicated fashions used to evaluate and worth threat and the socioeconomic dynamics concerned. To navigate this complexity, insurers rent groups of actuaries and knowledge scientists to quantify and differentiate amongst a spread of threat variables whereas avoiding unfair discrimination.

Whereas it could be laborious for policyholders to consider components like age, gender, and credit score rating have something to do with their chance of submitting claims, the charts under exhibit clear correlations.

Policyholders have cheap considerations about rising premium charges. It’s essential for them and their legislators to grasp that the present high-rate surroundings has nothing to do with the applying of actuarially sound score components and every thing to do with growing insurer losses related to greater frequency and severity of claims. Frequency and claims tendencies are pushed by a variety of causes – reminiscent of riskier driving habits and authorized system abuse – that warrant the eye of policymakers. Legislators would do nicely to discover methods to scale back dangers, include fraud different types of authorized system abuse, and enhance resilience, relatively than pursuing “options” to limit pricing that may solely make these drawback worse.

Study Extra

New Triple-I Points Transient Takes a Deep Dive into Authorized System Abuse

How Proposition 103 Worsens Danger Disaster in California

Louisiana Nonetheless Least Reasonably priced State for Private Auto, Owners Insurance coverage

IRC Outlines Florida’s Auto Insurance coverage Affordability Issues

Colorado’s Life Insurance coverage Information Guidelines Supply Glimpse of Future for P&C Writers

It’s Not an “Insurance coverage Disaster” – It’s a Danger Disaster

Indiana Joins March Towards Disclosure of Third-Celebration Litigation Funding Offers

Litigation Funding Regulation Discovered Missing in Transparency Division

[ad_2]