[ad_1]

What You Must Know

- Corporations resembling Citigroup and JPMorgan Chase are gearing as much as recruit a few of the wealth managers prone to be let go.

UBS Group AG will lower its workforce by between 20% and 30% after finishing its takeover of Credit score Suisse Group AG, SonntagsZeitung reported, as Swiss prosecutors began gathering proof as a part of a doable felony investigation into the deal.

As many as 11,000 staff shall be laid off in Switzerland, and one other 25,000 worldwide, the Swiss newspaper stated, citing an unidentified senior supervisor at UBS.

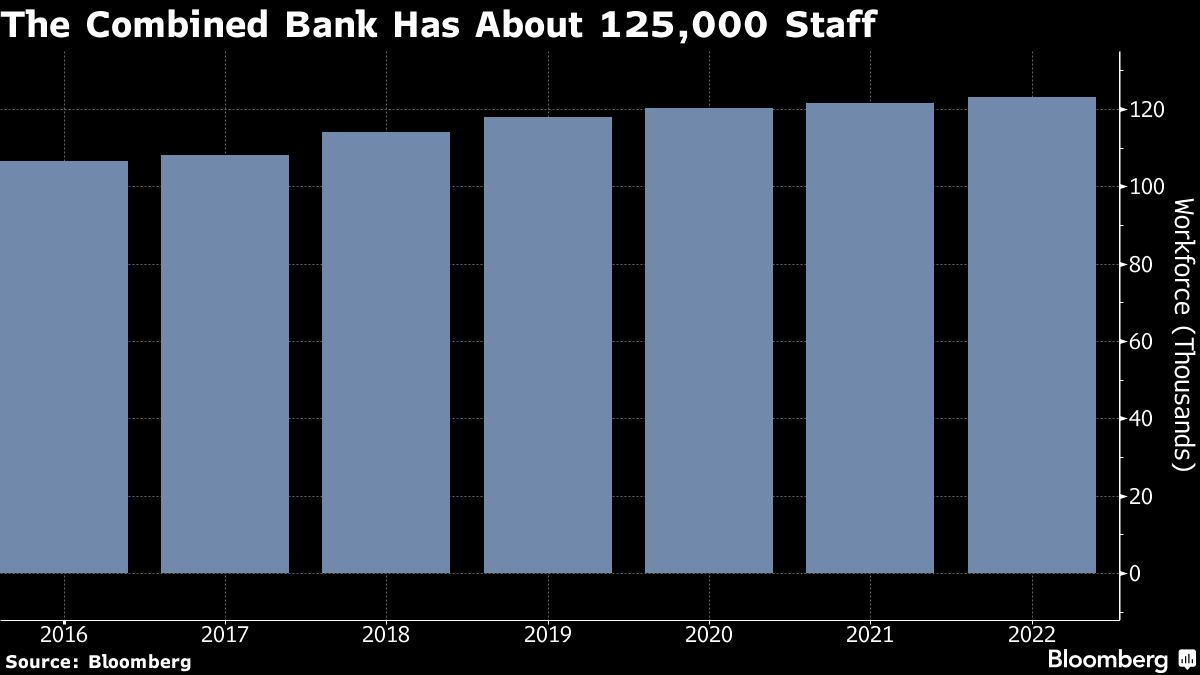

The 2 lenders collectively employed virtually 125,000 individuals on the finish of 2022 — about 30% of them within the house nation. A spokesperson for UBS declined to touch upon the report.

Swiss Investigation

In a separate improvement, Switzerland’s Workplace of the Lawyer Common stated Sunday it had opened a probe into the takeover and was working to determine doable crimes. The highest federal prosecutor ordered nationwide and regional authorities to analyze, in keeping with an announcement.

Years of scandals at Credit score Suisse culminated in large deposit outflows which might have seen it collapse the next Monday had motion not been taken, in keeping with Switzerland’s finance minister.

The emergency takeover of Credit score Suisse by its bigger competitor in a $3.3 billion deal was introduced by the Swiss authorities on March 19 after 5 days of talks brokered by officers.

The variety of predicted layoffs described by the newspaper dwarfs the 9,000 that Credit score Suisse introduced earlier than its rescue by UBS. The ultimate complete was anticipated to achieve a a number of of that quantity given the rivals’ sizable overlap.

Publicly, UBS has stated it is going to give readability on job cuts as quickly as it will probably. Whereas it was clear that main layoffs had been coming, the lender sees retention of expertise as a big a part of the takeover’s execution danger.

Corporations resembling Deutsche Financial institution AG, Citigroup Inc. and JPMorgan Chase & Co. are gearing as much as recruit a few of the funding bankers and wealth managers prone to be let go.

[ad_2]