[ad_1]

Robert Kiyosaki wrote one of many most-read private finance books of all time — Wealthy Dad, Poor Dad.

I learn it early on in my profession. It by no means actually did it for me however I can see why individuals latch onto the allegory he shares about studying the suitable monetary habits.

It’s factor to get individuals concerned about private finance as a result of nobody teaches you these items. They make you are taking Spanish or French in class however by no means educate the language of cash.

I ponder what Kiyosaki is as much as lately…

Oh expensive. That doesn’t sound good.

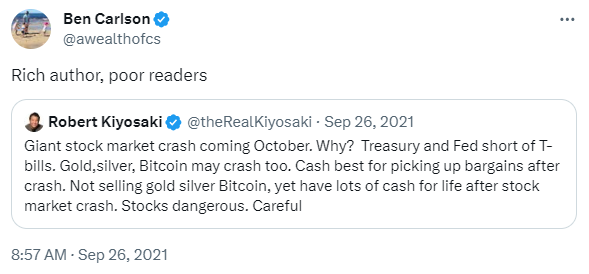

Wait a minute, I really feel like I’ve heard this earlier than:

Ah sure that’s proper. By some means he’s a private finance expert-turned-doomer.

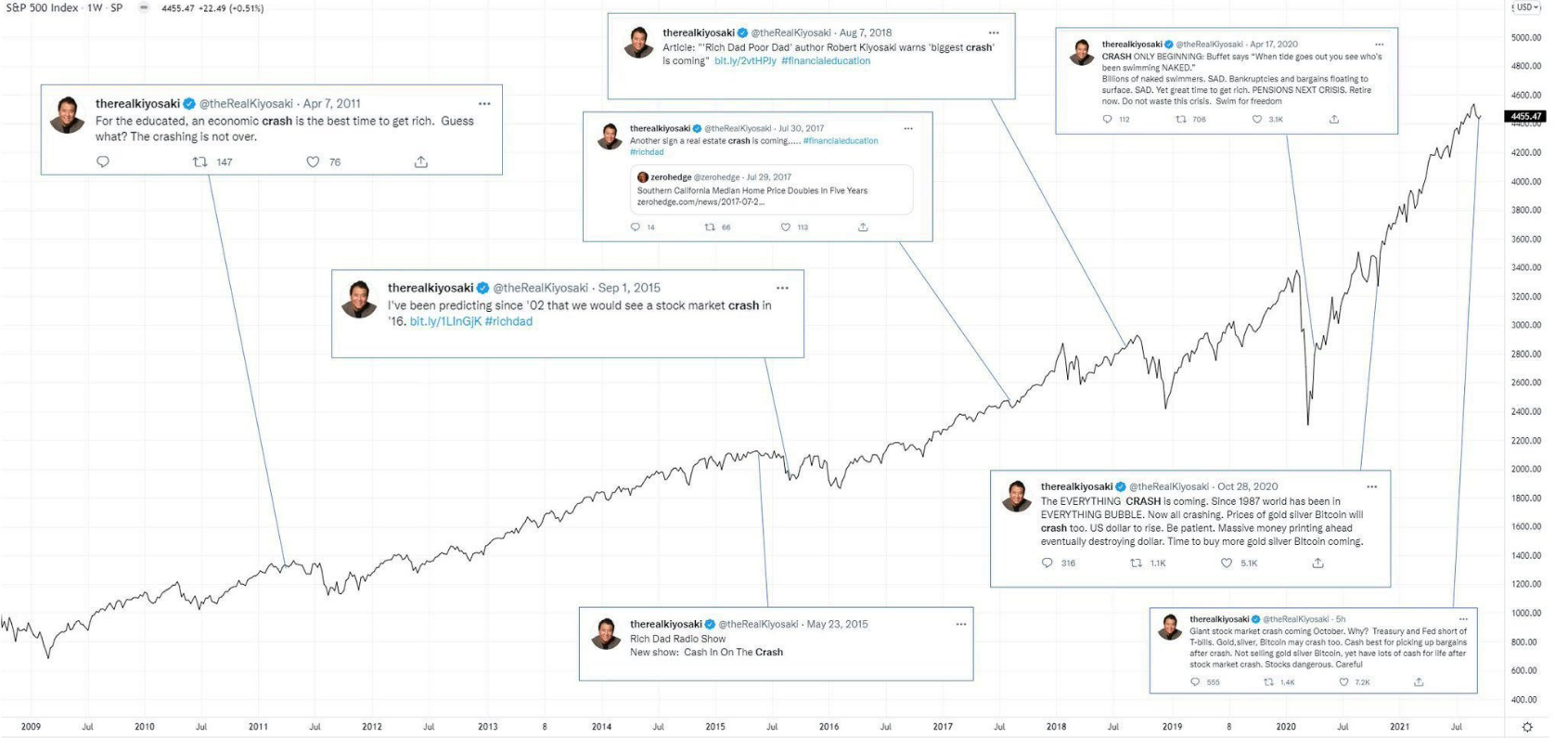

Fortunately, the Web makes it simple to maintain monitor of charlatans and their horrible forecasting data.

This man has been predicting the tip of the monetary system as we all know it for years:

I’ll by no means perceive the permabear mindset – these those that prey on the fears of others for private achieve.

I don’t thoughts people who find themselves rationally bearish infrequently. Generally the market is overvalued. It does crash. There are corrections and bear markets and recessions and black swan occasions from time-to-time.

As a long-term optimist, it’s useful to listen to an affordable bearish argument to maintain you grounded in actuality. More often than not issues are getting higher, however generally issues go improper.

Nevertheless, there’s a big distinction between bearish evaluation and permabear doomers.

Doomers are my sworn enemies.

Worry all the time sells (simply take a look at the information) however lots of the monetary doomers have been born out of the Nice Monetary Disaster. A part of it’s so few individuals predicted the 2008 crash forward of time that many turned to the likes of Zero Hedge so that they wouldn’t be caught flat-footed for the following disaster.

However there have been additionally individuals who grew to become well-known for “calling” or benefiting from the crash. Individuals like Meridith Whitney, John Paulson and Michael Burry. These individuals had books written about them. They have been paid large quantities of cash for talking gigs. They created new corporations or funds primarily based on their newfound fame.

To this present day, you continue to see headlines like this:

TRADER WHO PREDICTED THE 2008 CRASH THINKS SOMETHING ELSE WILL CRASH

These persons are nonetheless dwelling on being proper as soon as in a row, regardless that principally none of them have been proper ever since. Significantly, how lots of the individuals who “predicted” the 2008 monetary disaster have been proper about any market-moving occasions since?

Anybody? Bueller?

One of many most important causes I began this weblog is as a result of I used to be sick of all of the doom and gloom following the monetary disaster. Sure, that disaster was horrible, however we’ve skilled many horrible crises over the a long time.

This sort of factor occurs as soon as each 10-20 years. However following 2008 individuals latched onto the concept we must always get one each different 12 months.

The doomer, pessimistic, cynical mindset was like a virus. Social media and the Web unfold that virus like wildfire.

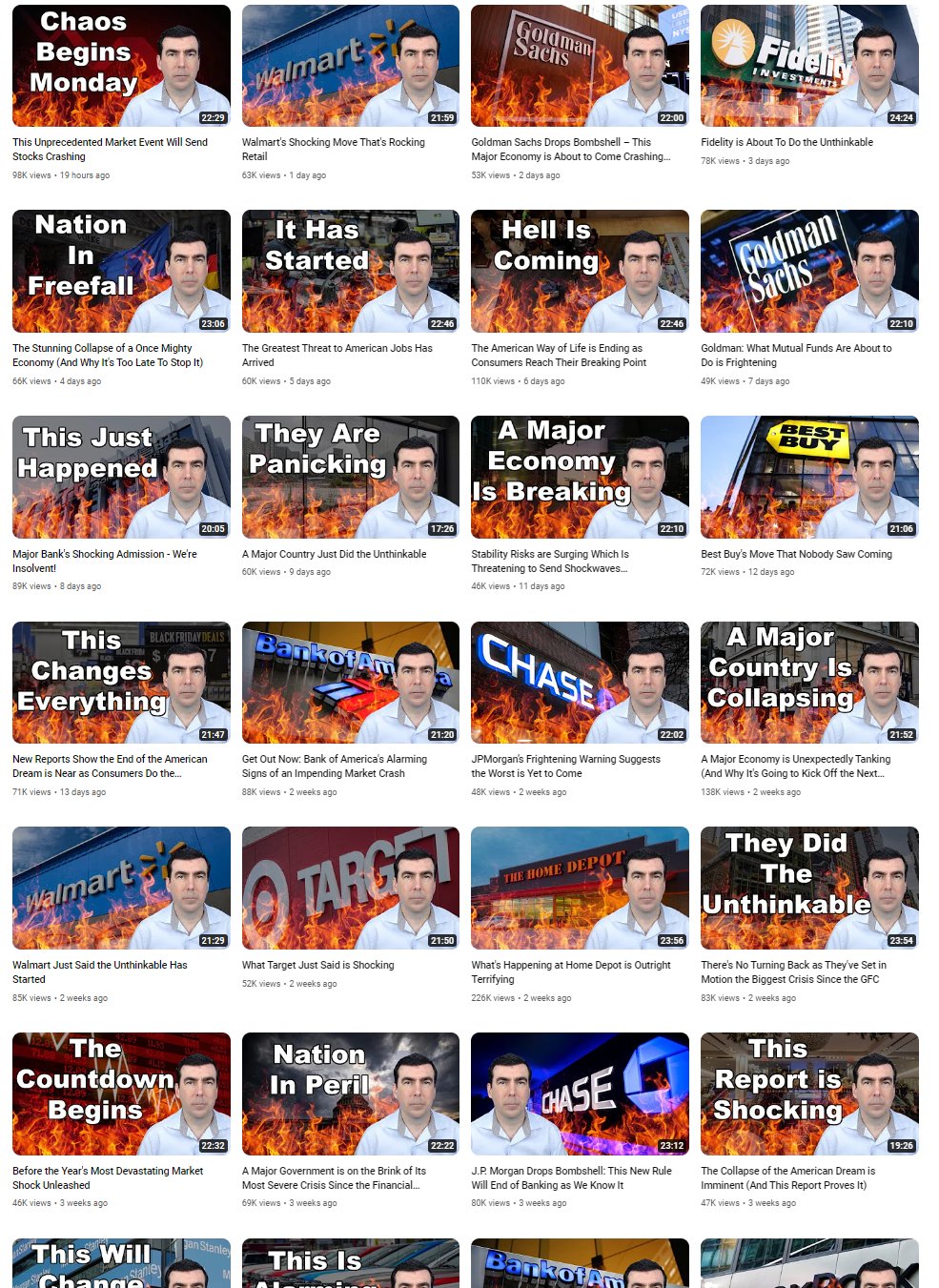

This sort of stuff:

This seems like AI created a doomer YouTube channel, however apparently, it’s actual. This man has a whole bunch of hundreds of people that watch his movies each week. It’s disgusting.

I don’t know what somebody like Robert Kiyosaki will get from predicting the worst crash the world has ever seen each six months. However I do know anybody following his recommendation can be poorer due to it.

The greenback goes to break down! Purchase silver cash!

The top of the monetary system as we all know it’s right here. Simply wait!

Shares are going to fall 90%! Canned meals is your solely hedge!

Certain, the world might finish in some unspecified time in the future however the permabears should not going that can assist you if that occurs. All they care about is profiting on the fears of others.

Actual monetary recommendation doesn’t attempt to scare you. Actual monetary recommendation turns complicated matters into easy explanations. Actual monetary recommendation doesn’t provide predictions; it affords perspective. It exhibits you the professionals and the cons, the prices and the advantages.

William Bernstein as soon as wrote, “The explanation that ‘guru’ is such a well-liked phrase is as a result of ‘charlatan’ is so arduous to spell.”

Wealthy charlatan, poor readers.

Michael and I talked about doomers, bulls and bears on this week’s Animal Spirits video:

Subscribe to The Compound so that you by no means miss an episode.

Additional Studying:

How one can Promote Finance Books Like Harry Dent

Now right here’s what I’ve been studying currently:

Books:

[ad_2]