[ad_1]

The venture goals to supply proof that the YuLife and gamified apps incentivise change whereas enhancing particular person well being and wellbeing outcomes.

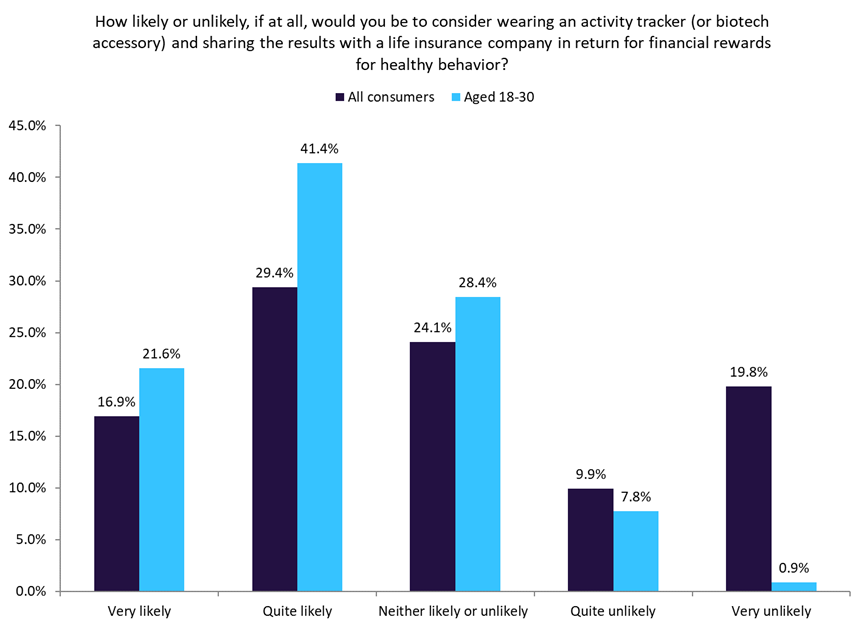

In the meantime, GlobalData surveying signifies youthful customers usually tend to share knowledge from a wearable health tracker with their well being insurer.

As per GlobalData’s 2022 UK Insurance coverage Client Survey, 46.3% of all UK customers counsel they’re prepared to share knowledge from a health tracker with a life insurance coverage firm in return for monetary rewards for wholesome behaviour. Notably, the willingness to share knowledge is far more pronounced amongst youthful people. Amongst these aged 18–30, this proportion rises to 63%. This implies the next stage of openness and acceptance of knowledge sharing amongst youthful demographics, probably pushed by components equivalent to familiarity with expertise and a larger emphasis on health-conscious behaviours.

Researchers on the College of Essex will use quantitative strategies (together with synthetic intelligence) and longitudinal analyses to find out the causal relationship between YuLife app engagement and enhancements in well being, equivalent to diminished cardiovascular threat, elevated bodily exercise, and improved psychological wellbeing. As well as, the venture ought to assist YuLife perceive the chance mitigation achieved by its app in addition to the financial influence on a enterprise and the well being of its workforce.

YuLife is an insurtech firm that specialises in offering revolutionary life insurance coverage options by integrating expertise and gamification into insurance coverage. Its main focus is on selling and incentivising wholesome life amongst people, with the purpose of enhancing general wellbeing. YuLife provides life insurance coverage merchandise that incorporate wellness programmes, whereby policyholders can earn rewards and advantages primarily based on their engagement in numerous wholesome actions. These actions are tracked by way of wearable units equivalent to health trackers, and the information collected is used to evaluate and monitor policyholders’ well being and wellbeing.

By incentivising wholesome conduct by way of monetary rewards, insurance coverage corporations can encourage people to undertake and keep a more healthy way of life. This strategy not solely advantages policyholders by probably decreasing their insurance coverage premiums or providing different monetary incentives, but it surely additionally advantages insurance coverage corporations by selling general wellbeing and probably decreasing the chance profile of their policyholders.

Nonetheless, there are limitations to uptake of wearable units. GlobalData’s 2022 UK Insurance coverage Client Survey signifies that knowledge privateness and safety considerations are the primary explanation why people wouldn’t take into account sporting an exercise tracker and sharing the outcomes with a life insurance coverage firm. 34.3% of respondents mentioned the rationale they’d not be prepared to put on an exercise tracker and share outcomes was as a result of it concerned sharing an excessive amount of private knowledge, whereas 25.5% of respondents indicated that they’d privateness considerations.

General, there’s potential for all times insurance coverage corporations to leverage the willingness of UK customers (notably youthful demographics) to share health tracker knowledge in return for monetary rewards. But insurers should guarantee strong knowledge safety measures and clear communication about how shopper knowledge can be used to be able to handle considerations and construct belief amongst their prospects.

[ad_2]