[ad_1]

Final 12 months the Nasdaq Composite was down greater than 32%.

This 12 months the Nasdaq is up practically 16%.

Final 12 months the S&P 500 was down 18%.

This 12 months the S&P 500 is up greater than 8%.

Final 12 months the Nasdaq skilled 46 down days of two% or worse, together with 18 buying and selling days of down 3% or worse. There have been additionally 40 days with constructive returns of two% or higher, together with 16 day by day features of three% or extra.

This 12 months the Nasdaq has seen simply 2 days of down 2% or worse and no 3% down days. There have been 7 day by day features of two% or extra, with simply a type of days being 3% or higher in 2023.

Final 12 months the S&P 500 skilled 23 down days of two% or worse, together with 8 day by day losses of three% or worse. There have been additionally 23 day by day features of two% or extra, together with 4 days with features of three% or extra.

This 12 months the S&P 500 has seen only one day by day lack of 2% or worse and no 3% down days. There has solely been one 2% up day and no 3% features in a day this 12 months.

The 12 months remains to be younger after all however there may be an apparent divergence within the value motion between 2022 and 2023.

This can be a good reminder about what typically tends to occur in several market environments.

Volatility clusters in a downtrend so that you get each huge down days and massive up days even because the market’s basic course is decrease.

In up-trending markets you don’t see as many huge strikes in both course.

You’re taking the steps up at a measured tempo and the elevators down in a rush.

It’s additionally price noting that dreadful years within the inventory market are sometimes adopted by great returns.

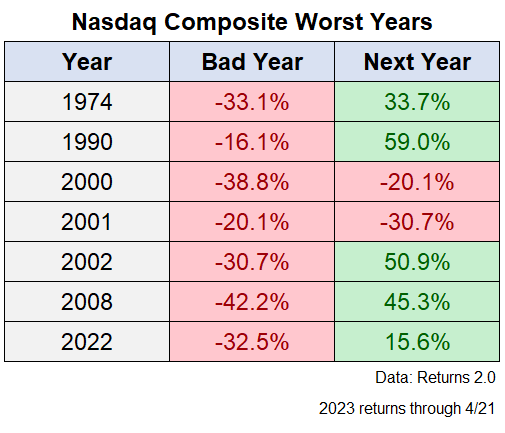

Here’s a take a look at the Nasdaq following each double-digit down 12 months going again to inception within the early-Seventies:

There are only a few ironclad guidelines with regards to inventory market patterns so that you’re not assured to expertise features simply because the earlier 12 months was a dud.1

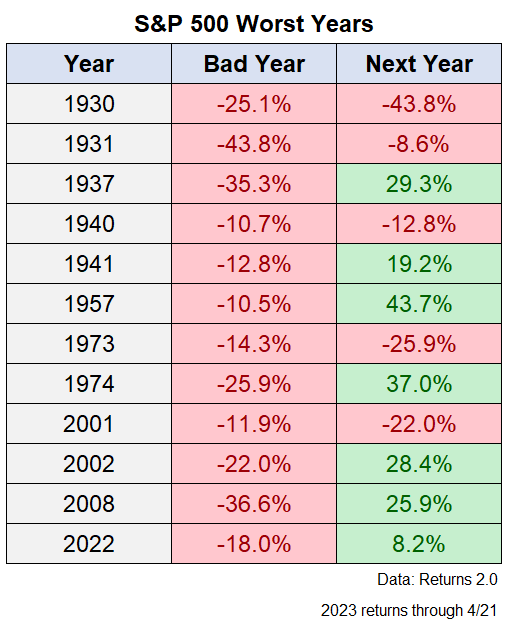

The S&P 500 has an identical profile with lots of hits but in addition some misses following a double-digit down 12 months:

After a very unhealthy 12 months within the inventory market you possibly can principally anticipate one among two issues to occur:

(1) Superb returns since bear markets don’t final ceaselessly and downturns make for great shopping for alternatives.

(2) A continuation of the unhealthy returns if issues flip right into a full-blown disaster state of affairs.

The excellent news concerning the present surroundings is it looks like the inventory market is pricing in an finish to the inflationary disaster days of 2022.

The unhealthy information could be if the tip to the inflationary disaster days of 2022 turns right into a nasty recession from a slowing financial system.

That is what makes investing within the inventory market so complicated within the short-run — you possibly can all the time discuss your self into the glass being half full or half empty irrespective of the course of the market.

It’s additionally why it pays to be a long-term investor with regards to shares.

Unhealthy issues can and can occur within the short-run and nothing is assured to traders in danger property.

However good issues are likely to occur when you could have a long-term mindset within the inventory market so long as you’re keen to endure some ache within the meantime.

Additional Studying:

2022 Was One of many Worst Years Ever For Markets

1I do know issues have been fairly loopy within the inventory market these previous few years however the efficiency of the Nasdaq from the late-Nineteen Nineties into the early-2000s in otherworldly. Listed below are the calendar 12 months returns beginning in 1995 by way of 2003:

- 1995 +41%

- 1996 +23%

- 1997 +22%

- 1998 +40%

- 1999 +86%

- 2000 -39%

- 2001 -20%

- 2002 -31%

- 2003 +51%

Unreal.

[ad_2]