[ad_1]

What’s in My Mannequin Portfolio is a brand new sequence wherein chief funding officers and analysts from prime RIAs within the wealth administration trade element their investments and asset allocation in shopper portfolios.

Sequoia Monetary Group, which was based in 1991, has an extended historical past of serving entrepreneurial purchasers all through the lifecycle of their wealth. The RIA has grown to over $15 billion in property, and it just lately launched a household workplace division, known as Sequoia Sentinel, to offer extra specialised providers to its ultra-high-net-worth purchasers,

WealthManagement.com spoke with Nick Zamparelli, senior vp, chief funding officer, Sequoia Monetary Group, who gives a glance inside one of many RIA’s mannequin portfolios, which features a 36% allocation to options.

WealthManagement.com: What’s in your mannequin portfolio?

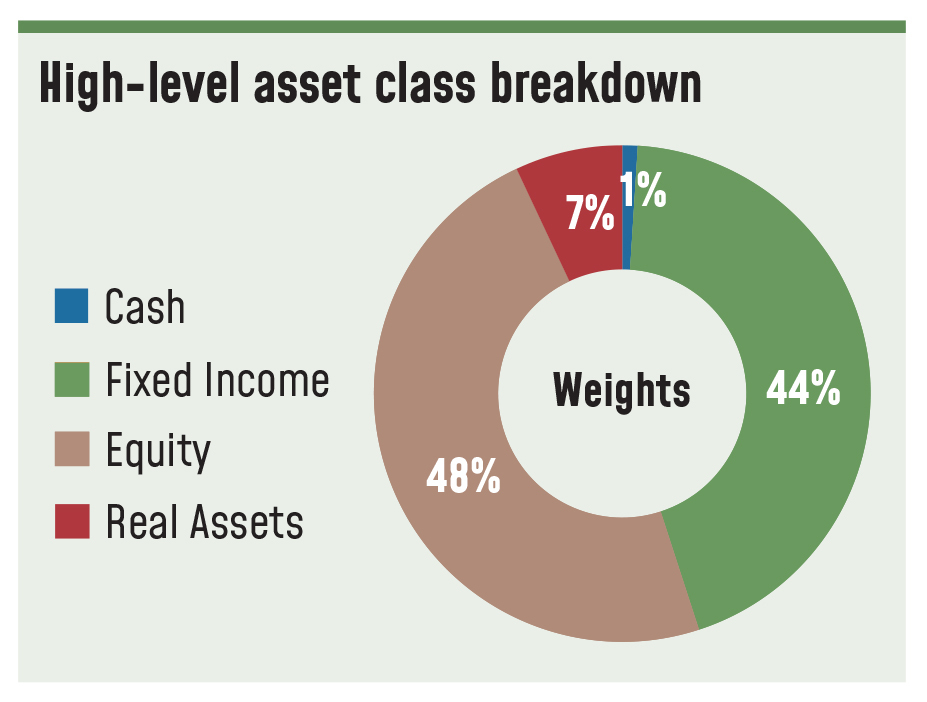

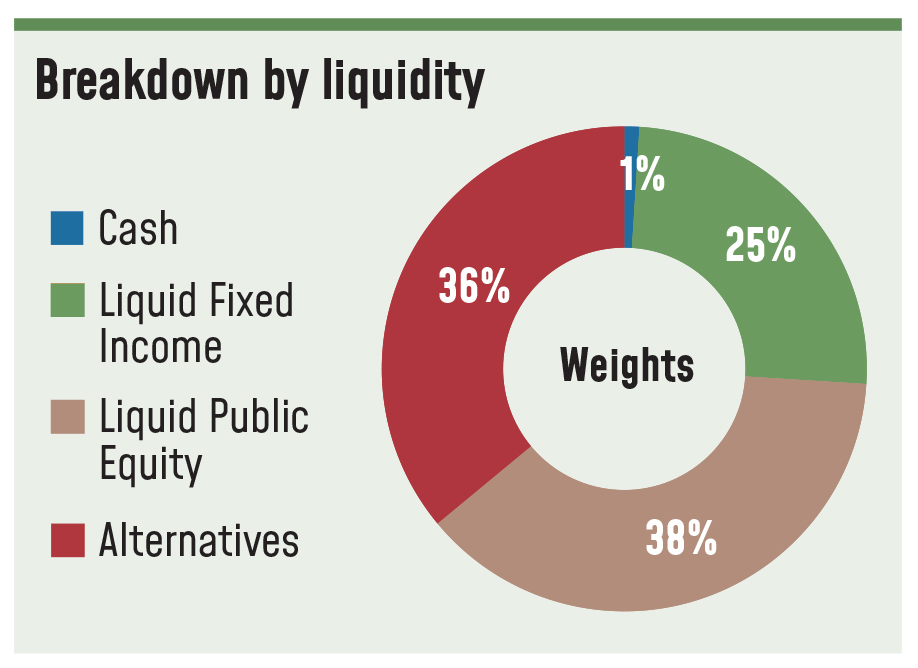

Nick Zamparelli: That is our 50/50 proxy mannequin. At a excessive degree, it contains money, fastened revenue (44%), fairness (48%), some actual property at 7%. However in case you break it out by liquidity, what you will see is that solely 25% is liquid fastened revenue. Solely 38% is liquid public fairness and 36% is alts. After which inside alts, I’ve it damaged out by personal credit score, personal fairness, hedge funds and actual property. We’re actually doing an excellent job mixing in these illiquid asset courses, and that is actually the place we generate outsized risk-adjusted returns.

Nick Zamparelli: That is our 50/50 proxy mannequin. At a excessive degree, it contains money, fastened revenue (44%), fairness (48%), some actual property at 7%. However in case you break it out by liquidity, what you will see is that solely 25% is liquid fastened revenue. Solely 38% is liquid public fairness and 36% is alts. After which inside alts, I’ve it damaged out by personal credit score, personal fairness, hedge funds and actual property. We’re actually doing an excellent job mixing in these illiquid asset courses, and that is actually the place we generate outsized risk-adjusted returns.

The Sequoia Sentinel, Sequoia’s household workplace division, shopper has the posh of affording a fabric quantity of illiquidity of their portfolio of property. It is nice for me as an asset allocator as a result of it actually opens up our universe of funding alternatives into alts, into illiquid property. It permits us to actually exit and search the very best risk-adjusted returns and seize illiquidity premiums and simply be actually considerate about how we’re constructing out their funding portfolios. The general aim clearly is to construct out considerate portfolio of property in essentially the most opportunistic method potential.

We use our personal set of capital market assumptions, which is one factor that basically differentiates us, notably within the personal house. Personal fairness screens nice in optimizers as a result of the usual deviation of returns seems artificially low merely as a result of it would not get marked as a lot. So, it appears to be like such as you’re producing higher than common fairness—higher than a public fairness returns at a decrease degree of danger, which everyone knows as buyers will not be true.

So, we make some changes in our mannequin, notably on customary deviation to point out that there’s in truth extra danger in personal fairness than public fairness, for instance. However we provide you with our customary set of capital market assumptions that we evaluate on an annual foundation.

WM: Have you ever made any huge funding allocation modifications within the final six months or so?

NZ: For, maybe, the primary time in my profession essentially the most contentious conversations inside the analysis workforce and admittedly with purchasers are taking place in what must be the danger mitigating phase of the portfolio. The entire fascinating conversations are occurring within the fastened revenue phase of the portfolio. So, to that finish, the query actually for the final 18 months is, when to begin leaning into length inside your fastened revenue phase, when to tackle a bit of bit extra rate of interest danger?

Lots of people have been very early—and understandably so given most would have thought that the economic system would have been extra delicate to the mountaineering cycle than it has turned out to be. Now, there’s a whole lot of the reason why that is the case, and I feel it was neglected by many market members that each shoppers and companies have been capable of time period out their debt at actually, actually low charges for a very long time.

So, this speedy improve that we noticed on Fed funds actually did not have an effect on their lives but. Now the query will turn out to be simply how for much longer. The Fed talks about lagged and variable results of rate of interest hikes. All of that stuff continues to be seeping into the economic system. And there’ll come a time when each shoppers and companies must refinance their debt. And in the event that they needed to do it at present—which they do not, fortunately—you then would see that financial sensitivity that folks have been anxious about. However we have not seen it but.

So, the largest change we have remodeled the previous six months is leaning into length of bid as charges have backed up.

I am making an attempt to determine a ballast within the portfolio from a danger perspective that offsets my return searching for property, my fairness danger, if you’ll. And the place charges are at present, I feel you possibly can lastly say that, hey, if we actually get a contraction within the economic system, that fastened revenue at present goes to assist offset a few of that fairness danger as a result of charges will are available in and so they’ll are available in fairly aggressively. Everybody’s ready for charges to come back down, but when they arrive down for the incorrect causes, it isn’t an excellent factor for the fairness market. So, in the event that they’re coming down as a result of there are actual financial issues, it isn’t going to be favorable to equities as a result of, whereas multiples could profit, the denominator definitely will not be going to learn.

I am making an attempt to determine a ballast within the portfolio from a danger perspective that offsets my return searching for property, my fairness danger, if you’ll. And the place charges are at present, I feel you possibly can lastly say that, hey, if we actually get a contraction within the economic system, that fastened revenue at present goes to assist offset a few of that fairness danger as a result of charges will are available in and so they’ll are available in fairly aggressively. Everybody’s ready for charges to come back down, but when they arrive down for the incorrect causes, it isn’t an excellent factor for the fairness market. So, in the event that they’re coming down as a result of there are actual financial issues, it isn’t going to be favorable to equities as a result of, whereas multiples could profit, the denominator definitely will not be going to learn.

WM: Have you ever made any modifications on the fairness aspect?

NZ: We have added some brief publicity to our fairness e-book. We did that round April or Might. We’re not betting that the market goes down, however we wish to take among the volatility out of the potential modifications in fairness markets. It is turned out to be an actual profit to the portfolio as a result of it served the aim of tamping down the volatility of our fairness returns.

WM: What differentiates your portfolio?

NZ: The analysis course of, in and of itself, actually differentiates us from our rivals. If we’re in search of publicity to a sure asset class, I’ve received seasoned professionals which can be subject material specialists that may actually discover the very best methods to articulate these desired exposures. And these guys have a Rolodex. They are not out doing a contemporary search each time. They have sufficient expertise of their space of experience the place they have a bench, they have a roster, they have a Rolodex to select from.

WM: What are your prime contrarian picks?

NZ: One is small cap shares. Have they underperformed and for an excellent purpose. With the speed setting that we’re in, a whole lot of small cap shares, the iShares Russell 2000 Worth ETF (IWM) for instance, is riddled with firms which have lower than stellar steadiness sheets and must entry the capital markets to fund their development. They usually cannot do it on this setting. That mentioned, it is an space of development that we definitely need publicity to, and we’re very cognizant of the truth that over lengthy durations of time, small cap shares have outperformed. In order that’s an space that we’re trying to lean into proper now.

Worldwide fairness is one other space of the market that has underperformed for 15 to 16 years now. Once we begin to see development alternatives broaden out globally, you are going to see a possibility for worldwide shares and rising markets to actually begin to outperform. You additionally will get a profit if we ever see the greenback weaken. That might be a giant advantage of proudly owning worldwide equities and rising market equities. We’re additionally beginning to have a look at some bond proxy fairness sectors which have simply been decimated.

WM: What funding automobiles do you employ?

NZ: We’ll go from passive to very, very lively. We’ll use passive ETFs the place we do not assume the market is inefficient sufficient to pay for lively administration. For instance, we are going to attempt to make use of passive tax advantaged methods to get our U.S. massive cap publicity, which is a really environment friendly market and really troublesome for lively managers to outperform, notably given the focus in that house. However within the areas the place it is much less environment friendly—worldwide markets, rising markets, small caps—we are going to exit and discover who we expect are the very best technique managers. So, we’ll use ETFs, we’ll use mutual funds, we’ll use personal partnerships.

NZ: We’ll go from passive to very, very lively. We’ll use passive ETFs the place we do not assume the market is inefficient sufficient to pay for lively administration. For instance, we are going to attempt to make use of passive tax advantaged methods to get our U.S. massive cap publicity, which is a really environment friendly market and really troublesome for lively managers to outperform, notably given the focus in that house. However within the areas the place it is much less environment friendly—worldwide markets, rising markets, small caps—we are going to exit and discover who we expect are the very best technique managers. So, we’ll use ETFs, we’ll use mutual funds, we’ll use personal partnerships.

We now have our personal inner partnerships that we have created to get publicity to a whole lot of illiquid asset courses. We now have our personal technique known as Area of interest Credit score, which is in non-traditional areas of fastened revenue, like dislocation funds, distressed funds, extra opportunistic areas of the market that transcend simply merely selecting excessive yield, for instance. And on the personal fairness aspect, we now have a sequence of classic funds. We’ll discover methods throughout the spectrum of enterprise all the best way to late stage buyout. A few of these are accredited funds, some are Certified Purchaser funds. Most of our purchasers within the household workplace are QPs.

WM: What are the alternatives you see in actual property proper now? Are there any specific segments that you are going after or buildings you’re utilizing?

NZ: In personal markets, we truly exit and purchase direct offers. So we personal some industrial workplace buildings in suburban Philadelphia. We personal some scholar housing initiatives—one at Penn State, one at College of Delaware, one on the College of Alabama. Our scholar housing portfolio is performing very, very effectively. Our industrial workplace is struggling a bit.

We discovered that by proudly owning and working particular person actual property property, we may generate a fairly wholesome yield for our purchasers. And relatively than underwriting the credit score high quality of an organization in fastened revenue, you are actually underwriting the credit score high quality of the tenant and the intentions of the tenant.

We’ll use infrequently actual property funds. For instance, we have invested in an industrial actual property fund the place it was simply industrial and warehouse actual property house.

And we additionally will use public REITs. Proper now I’d recommend that public REITs, which have already discounted the values of the underlying property through the general public markets, could also be extra fascinating methods, at the very least tactically, to get publicity to actual property than what you are able to do within the personal markets. It’s actually troublesome on this financing setting to get an actual property deal to pencil out while you’re taking over debt at these ranges. It has been very, very troublesome so as to add new direct actual property alternatives to the portfolio. There might be misery, and we now have capital to deploy. So, we might be opportunistic there for certain.

WM: How are you addressing the inflationary setting inside the portfolio?

NZ: Equities generally is a actual hedge towards inflation. Proper now, if we’re anxious about something, we’re anxious in regards to the client. The patron in our view, from what we will see for the true time information that we’re listening to from firms, is getting extra discerning, and the extra discerning they get, the harder it will be for firms to cross by means of pricing. The harder it’s for firms to cross by means of pricing, the extra they run into margin points. So, you throw that margin headwind up towards rates of interest and rapidly you’ve got received a possible for earnings to underperform versus estimates.

WM.com: How a lot are you holding in money and why?

NZ: For us, there are two causes to carry money: One is frictional only for shopper bills, which generally is 1% on a regular basis, not a fabric quantity. Or, we may use it as a tactical allocation inside our fastened revenue portfolio. If we have been actually good, we’d’ve gone to all money and T-bills initially of this 12 months, after which proper round now we’d’ve swapped that into one thing lengthy length. We’ll do this infrequently to handle the length of our fastened revenue portfolio.

WM.com: Are you incorporating ESG into the portfolio? If that’s the case, how?

NZ: ESG has been actually powerful for us as a result of it is an space the place we do not essentially belief a whole lot of the knowledge that we’re getting so far as what makes one thing enticing from an ESG perspective. We have not gotten utterly comfy with the info. That mentioned, a whole lot of our ESG-related investments are shopper pushed. So, when we now have a shopper that has a specific hankering for one thing or they’ve a specific view or they need publicity to one thing or they wish to keep away from one thing, we are going to work with them and discover the very best methods to try this. We’ll dig in and do some actual diligence to search out them areas the place they will be ok with their investments.

[ad_2]