[ad_1]

Threat is far less complicated than what you see on TV – right here’s why:

When you watch TV, chances are high your notion of danger has been incorrectly formed by the media. Their definition of danger is warped by their industrial must preserve you watching. What they need you to imagine is that volatility equals danger.

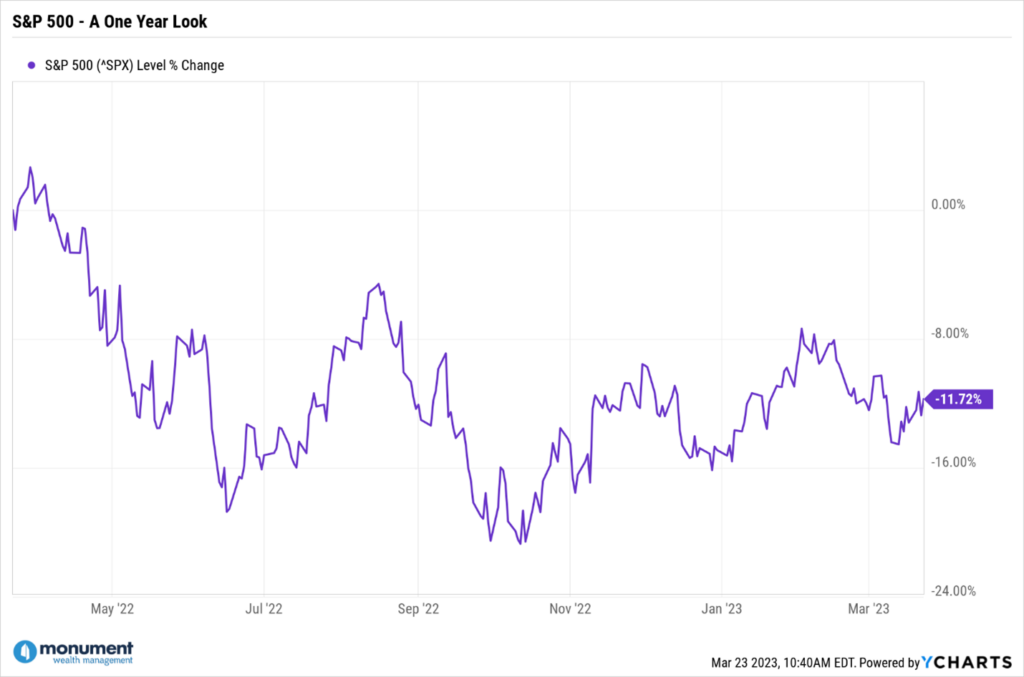

They need you to see this:

Now, that is the best strategy to view VOLATILITY, however the mistaken strategy to view RISK.

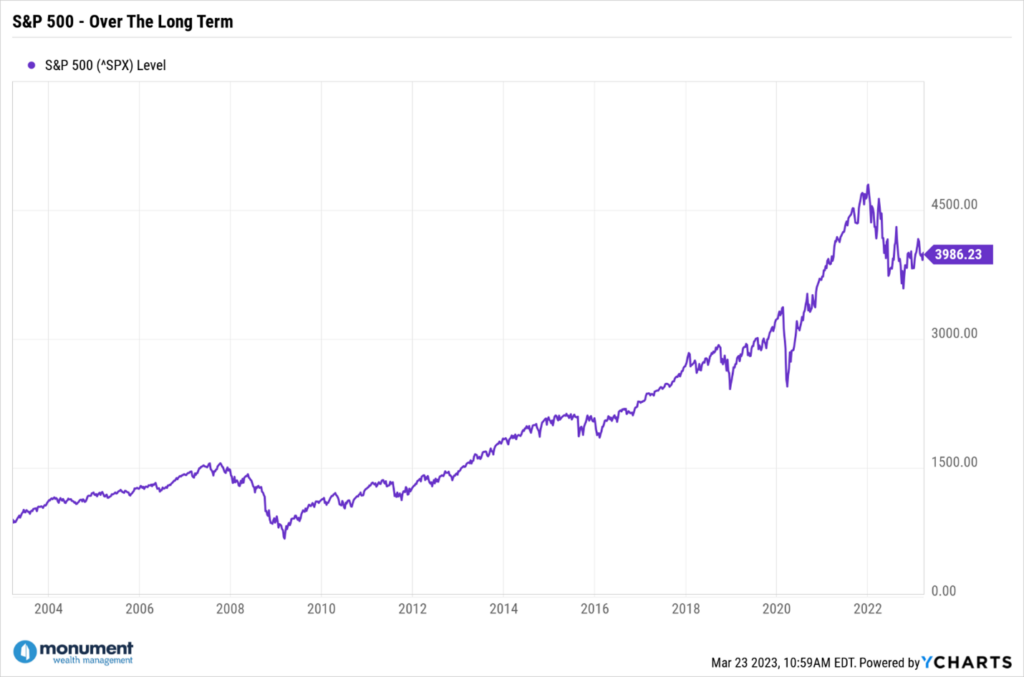

What you NEED to see is that this:

If you take a look at it this manner, you see that danger, when managed correctly, can truly make you rich.

There are two methods an investor must see RISK.

TWO WAYS. Interval. Nicely, not less than that’s my OPINION. However nonetheless, simply two:

#1: The chance that you just lose all of your cash.

#2: The chance making a decision the place the end result reduces the chance of achieving your targets.

I all the time like to verify folks bear in mind the phrases “chance and chance.”

Is #1 doable? In fact.

Is it possible? I say it’s very low…as near zero as doable.

Why? The long-term diversified market (let’s name that the S&P 500) has all the time been constructive.

Want extra proof?

Learn Jeremy Siegal’s e-book, “Shares for the Lengthy Run” which was revealed in 1994 and is now in its sixth version.

Are there PERIODS of time the S&P 500 was down? In fact, however that’s volatility. Bear in mind, danger is about LOSING one thing…actual losses.

#2 is more likely as a result of now you’re speaking about DECISIONS with human enter (additionally known as meddling).

Threat is commonly launched by buyers themselves and usually rears its head in periods of draw back volatility via statements akin to, “I ought to regulate to one thing extra conservative by lowering my fairness publicity.”

It creates a paradox – in an try to cut back danger, danger is definitely launched.

Have a Technique to Cope with Threat and Volatility.

You may have a strong technique to take care of each danger and volatility by creating and following a plan you create if you end up not experiencing or coping with both.

Your long-term technique needs to be set as much as provide the highest chance of attaining your targets. To try this, it’s crucial to cut back and even remove the RISK of constructing dangerous selections by eradicating the necessity to truly MAKE selections within the first place (since I’ll argue the opposite long-term danger of dropping all of your cash is basically non-existent).

Your short-term technique needs to be managing your want for the portfolio to supply money throughout occasions of elevated VOLATILITY. Having money makes you financially unbreakable since you don’t must promote belongings at depressed costs throughout market downturns. That might be an instance of a choice that causes the lack of cash – which is, once more, the definition of danger.

Right here’s a strategy to see it:

When you had topped off 18-months of money reserves at the start of 2022, you’d STILL be residing out of these reserves, eliminating any pressured liquidation of belongings to keep up the identical life-style…making the downturn irrelevant and maintaining the danger of not attaining your long-term targets out of the image. THAT’S being financially unbreakable.

Don’t get it twisted – the media desires to outline volatility as danger. It’s not. All the time do not forget that.

If you’re a Monument consumer and you’re involved about both danger or volatility, please instantly attain out so we will have a chat.

If you’re not a consumer and our philosophy on danger and volatility is sensible, attain out should you need assistance developing with a technique and a plan to deal with each.

Giving folks unfiltered opinions and simple recommendation is our price proposition. Oh yeah, and we additionally love canines.

Preserve wanting ahead,

[ad_2]