[ad_1]

The inventory market crashed greater than 85% from 1929-1932 throughout The Nice Melancholy.

Tens of millions noticed their funds get decimated in that interval however for most individuals it was from the financial system getting crushed, not their portfolios.

Again then the inventory market was a spot reserved just for the rich and bucket store speculators. The truth is, lower than 1% of the inhabitants was even invested within the inventory market heading into the nice crash.

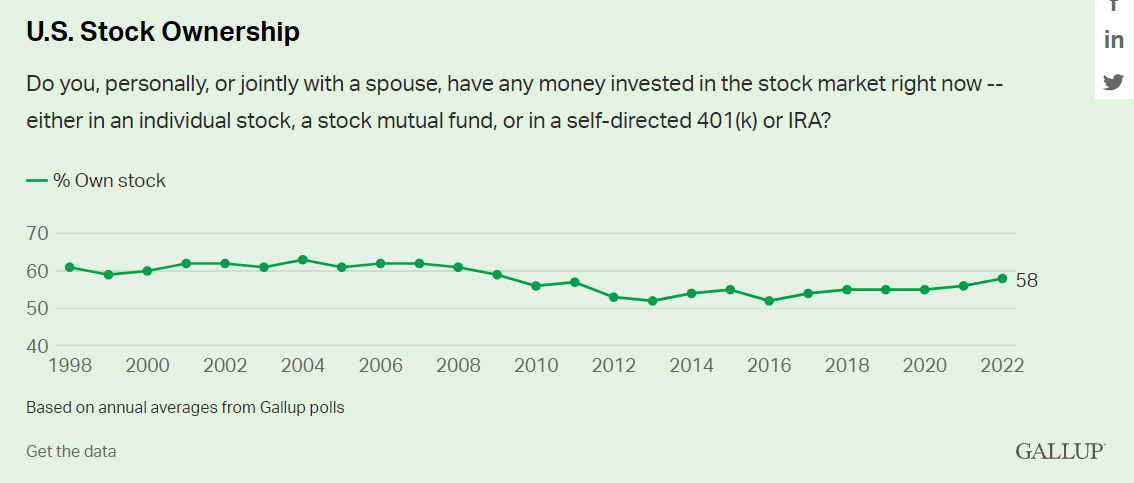

There may be nonetheless inequality within the inventory market in the present day however way more folks participate in a single kind or one other. The newest estimate is near 60%:

The appearance of index funds, IRAs, 401ks, low cost brokerages, ETFs and on-line entry have all made it a lot simpler to participate within the biggest wealth-building machine ever created.

The truth that you should buy the complete inventory marketplace for pennies on the greenback in charges with the push of a button is among the greatest issues to ever occur to particular person buyers.

Most individuals merely don’t have the power, know-how or time to construct a portfolio of particular person shares on their very own.

A diversified, tax-efficient, low-cost, low-turnover funding car exists for the inventory market however not the housing market.

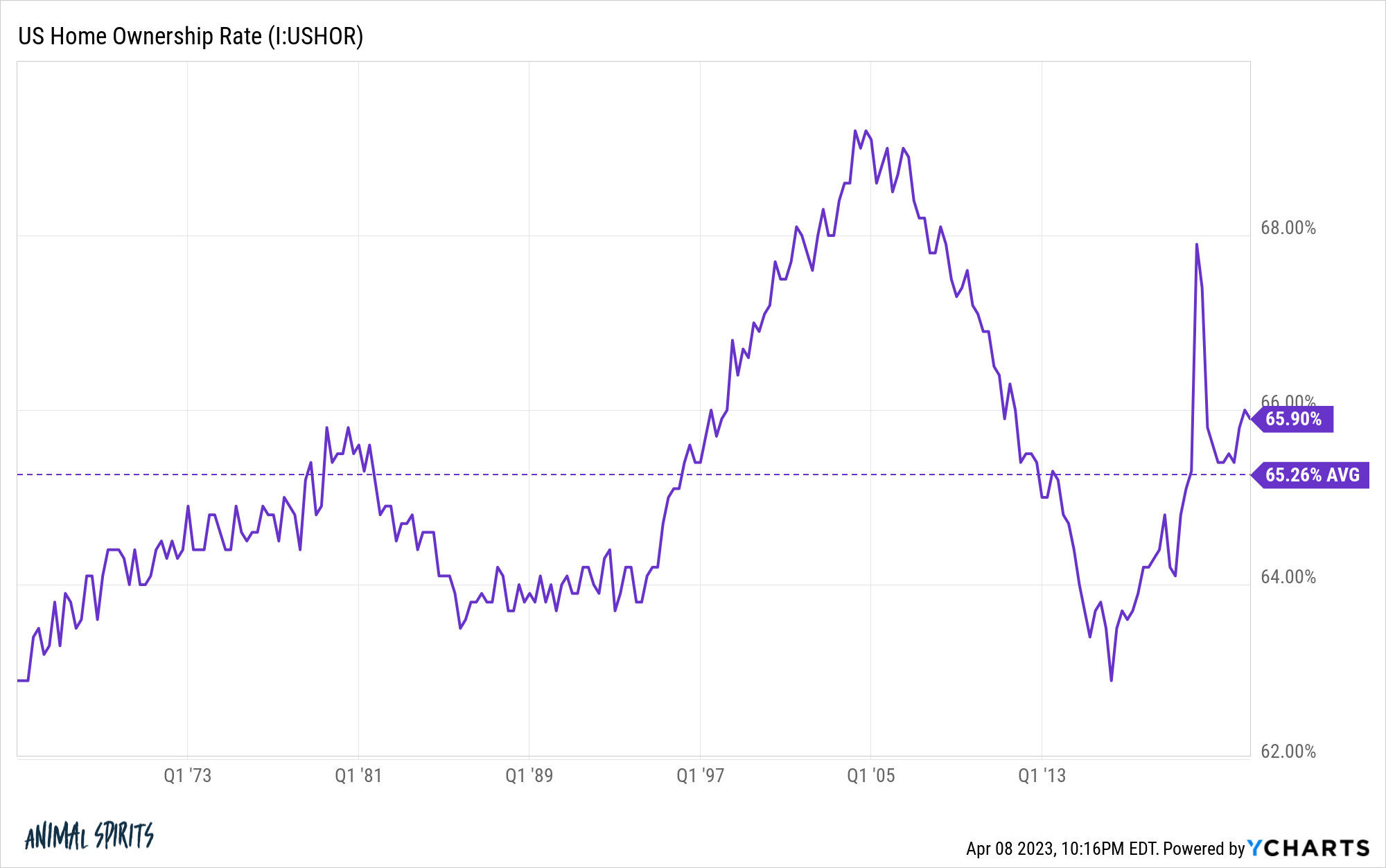

Whereas inventory market possession throughout the Nice Melancholy was a rounding error of the full inhabitants, loads of folks owned homes.

Actual property obtained obliterated similar to all the pieces else within the financial system again then however the homeownership price nonetheless solely obtained as little as 44% following the Nice Melancholy.

Following the post-WWII increase the U.S. homeownership price1 shortly elevated to greater than 60%. That quantity has been near two-thirds ever since:

The homeownership price is excessive however diversification for the overwhelming majority of these owners stays low.

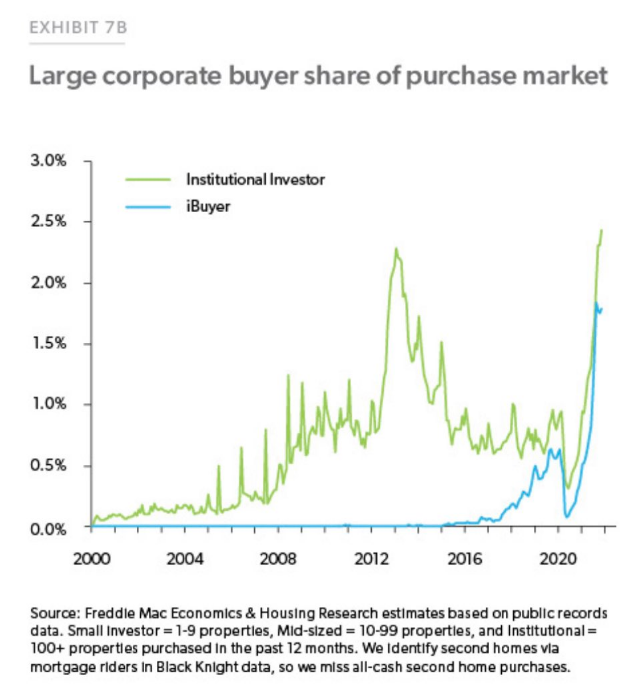

Establishments personal a lot of the shares within the inventory market. The housing market is dominated by common folks and small particular person buyers.

There’s a conspiracy idea that giant monetary companies like BlackRock have been shopping for the entire homes in recent times however even with an uptick in institutional gamers throughout the low mortgage price days, they nonetheless represent lower than 3% of the acquisition market:

Most homes are owned by people that dwell in them whereas the rental market is owned by largely small-time buyers.

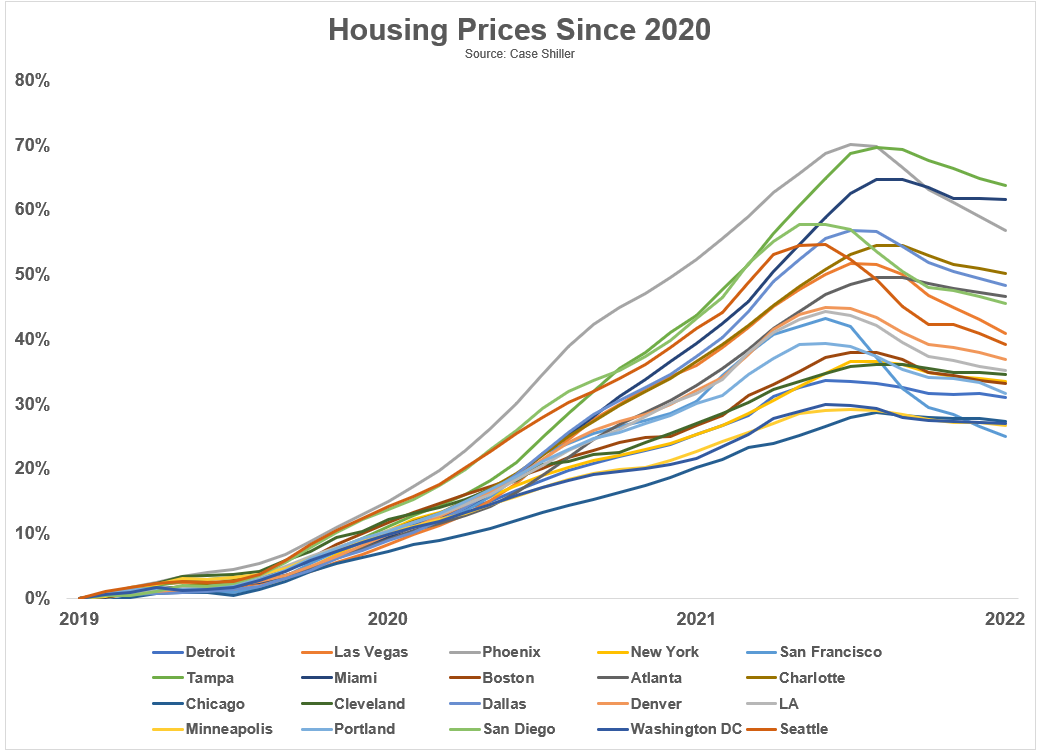

Folks within the finance business like to speak in regards to the housing market as if it’s a single entity similar to the inventory market however residential actual property stays hyper-local.

If we equate shopping for a home with shopping for shares, most individuals have their cash concentrated in a single place the place the precise returns are dominated by micro components as a lot because the macroeconomy.

Case-Shiller tracks the efficiency of the 20 largest housing markets within the nation. You may see loads of divergences within the returns because the begin of the pandemic:

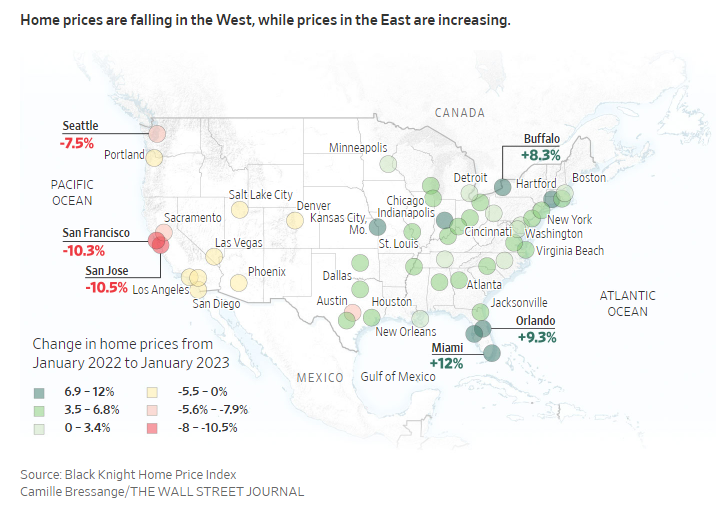

Costs went crazier in some locations than in others. Now some areas are seeing costs roll over sooner than others.

Redfin’s newest housing market replace exhibits how sure cities have seen costs are available in significantly whereas different areas of the nation proceed to expertise sturdy value appreciation:

Dwelling costs dropped in additional than half (28) of the 50 most populous U.S. metros, with the largest drop in Austin, TX (-14.7% YoY). Subsequent come 4 West Coast metros: Sacramento (-11.7%), Oakland, CA (-10.4%), San Jose, CA (-10.2%) and Seattle (-9.6%). That’s the largest annual decline since at the least 2015 for Seattle.

On the opposite finish of the spectrum, sale costs elevated most in Milwaukee, the place they rose 11.4% yr over yr. Subsequent come Fort Lauderdale, FL (8.9%), West Palm Seaside, FL (8.2%), Miami (7.9%) and Columbus, OH (6.3%).

On a nationwide degree, the median U.S. home-sale value fell 2.1% yr over yr to roughly $362,000, marking the seventh straight week of declines after greater than a decade of will increase.

That nationwide median value makes for good macro speaking head fodder however is basically ineffective to anybody really shopping for a home in their very own neighborhood.

The Wall Road Journal lately broke down the bifurcation in housing market costs by east versus west:

There are clearly macroeconomic components that affect consumers and sellers all throughout the nation. Mortgage charges, in fact, are a giant one, particularly now.

However in the event you’re attempting to calculate the precise returns on housing there are such a lot of idiosyncratic components concerned. Location is a giant one however you additionally must consider property taxes, the age of the home, facilities, upkeep, insurance coverage, potential HOA charges, the price of dwelling and weather-related dangers.

Housing is way and away the largest monetary asset for many households in the USA and it’s almost not possible to diversify the chance of that concentrated place.

Positive there are REITs, actual property ETFs, mutual funds or different funding autos that construct, purchase or develop actual property however there is no such thing as a S&P 500 or whole inventory market index fund for housing.

You’ve gotten your own home in your metropolis in your faculty district in your neighborhood together with your particular housing traits.

It’s a very good factor index funds do exist for different monetary belongings. They mean you can diversify your monetary belongings outdoors the roof over your head.

Additional Studying:

The place Have All of the $200,000 Homes Gone?

1The homeownership price is calculated by dividing the variety of owner-occupied housing items by the variety of occupied housing items or households. It’s by no means been clear to me how multi-family housing items like flats or townhouses affect this calculation.

[ad_2]